Can A Widow Thats 54 Draw From Her Husband Retirement Of A Public School

"Can I go teacher's retirement and Social Security?"

That's ane of the most commonly asked questions that I encounter in my Facebook group Social Security WEP & GPO Discussion.

There's no doubt this tin can be a complex topic and virtually of the teachers that I've talked to have seen lots of conflicting information — so let'south articulate up the confusion and take a closer look at the rules on teacher's retirement and Social Security.

In the 1970s and 1980s, laws were passed that amended the Social Security rules to keep individuals from "double dipping," or receiving both a Social Security do good and a pension from a chore where they did not pay into the Social Security system.

The results of these amendments are ii rules that could impact your ability to claim your total Social Security benefit as a teacher: The Windfall Elimination Provision (WEP) and the Authorities Pension Offset (GPO).

These provisions reduce (or eliminate) benefits for those who worked in a job in which they:

- Qualified for a alimony and

- Did not pay Social Security taxes.

This is non limited to teachers. Other professions that often fall into this group include public sector workers similar firefighters, law officers and numerous other state, canton and local employees.

In the beginning, Social Security didn't encompass any public sector employees. Simply as many states dropped their own pension plans and adopted coverage agreements with the Social Security Administration, things have inverse.

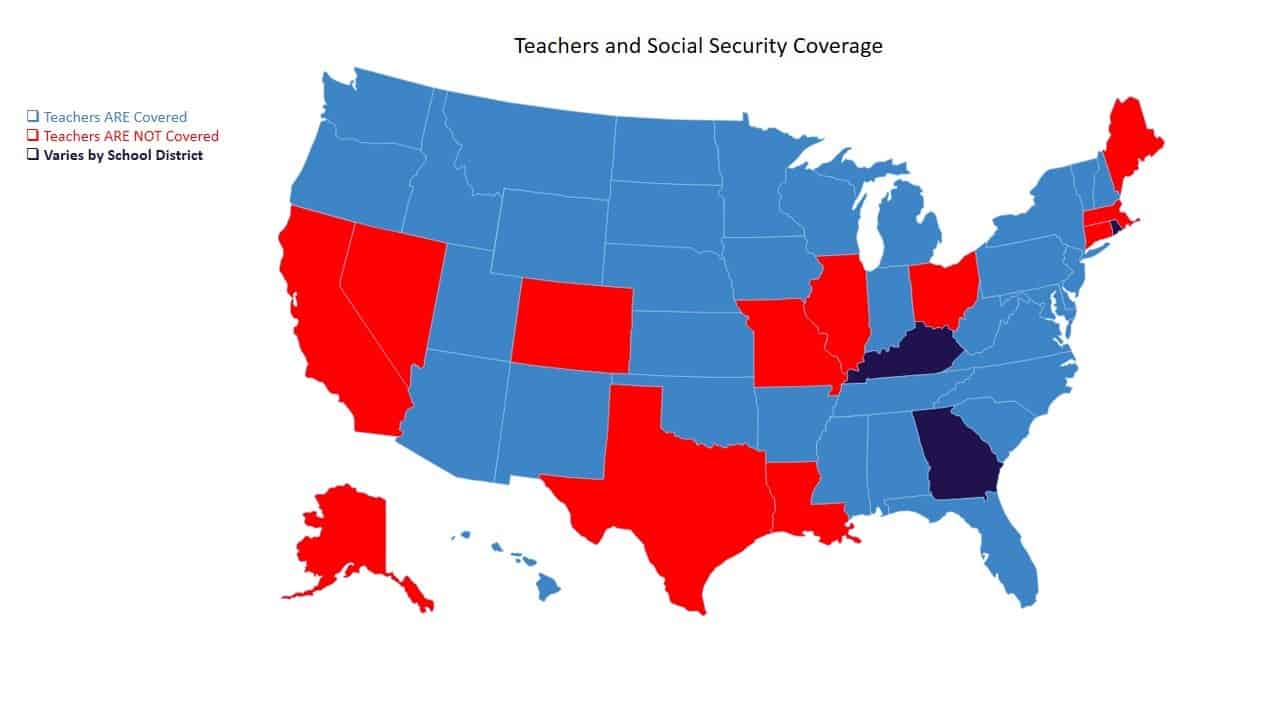

Today there are still 15 states that participate solely in their own alimony plans instead of Social Security:

Those states are:

- Alaska

- California

- Colorado

- Connecticut

- Georgia (some school districts)

- Illinois

- Kentucky (some school districts)

- Louisiana

- Maine

- Massachusetts

- Missouri

- Nevada

- Ohio

- Rhode Isle (some school districts)

- Texas

If you lot are a teacher in one of those states, the rules for collecting a Teacher's Retirement System (TRS) alimonyand Social Security can be confusing and maddening to try and figure out.

That's specially truthful if you've paid into the Social Security organization for enough quarters to qualify for a do good, which is adequately common among teachers.

Many teachers find themselves in this situation for a variety of reasons. For some, teaching is a second career, after they've spent years working in a job or a state where Social Security taxes were withheld.

Others may accept taught in a state where teachers practice participate in Social Security. For instance, teachers in my town, which is divided between united states of Arkansas and Texas, could qualify for both.

If they worked in Arkansas (where teachers do participate in Social Security) for at least 10 years and and then taught in Texas (where teachersdon'tparticipate in Social Security), they would qualify for both Social Security and the Teacher Retirement Organisation of Texas.

UPDATE: Don't leave without getting your Gratis copy of my latest guide: Superlative ten Questions and Answers on the Windfall Emptying Provision. You CAN simplify these rules and become every dime in benefits you deserve! Simply click here.

How to Understand Your Social Security Benefit If You Worked in Both

This may surprise you but your Social Security statementdoes not reverberate whatever reduction in benefits due to your teacher'southward pension. They'll wait until you file to tell you what the reduction is if you qualify for both a instructor's retirement and Social Security benefits.

Understanding if a reduction in benefits will apply to y'all, and how much that will exist, does non have to wait until you file for Social Security. You tin can become a good idea today past understanding the key differences between the ii rules which may reduce your benefit amount:

- The Windfall Elimination Provision (WEP)

- The Government Pension Kickoff (GPO)

From a very high level, you should understand that the WEP rule simply applies to individuals who are eligible for a Social Security benefitbased on their own work history and have a pension from work where they did non pay Social Security tax.

Meanwhile, the GPO dominion only applies to individuals who are entitled to a Social Security benefitequally a survivor or spouse and have a alimony from a Federal, state, or local government task, in which they did not pay Social Security revenue enhancement.

Here's a look at how each rule would touch your benefit.

Understanding the Windfall Emptying Provision

The Windfall Elimination Provision (WEP) is merely a recalculation of your Social Security do good if you also take a pension from "not-covered" work where no Social Security taxes were paid. The normal Social Security calculation formula is substituted with a new calculation that results in a lower benefit amount.

It would exist easy to write a multipage essay on the WEP, but the necessary components tin exist distilled to a few simple points:

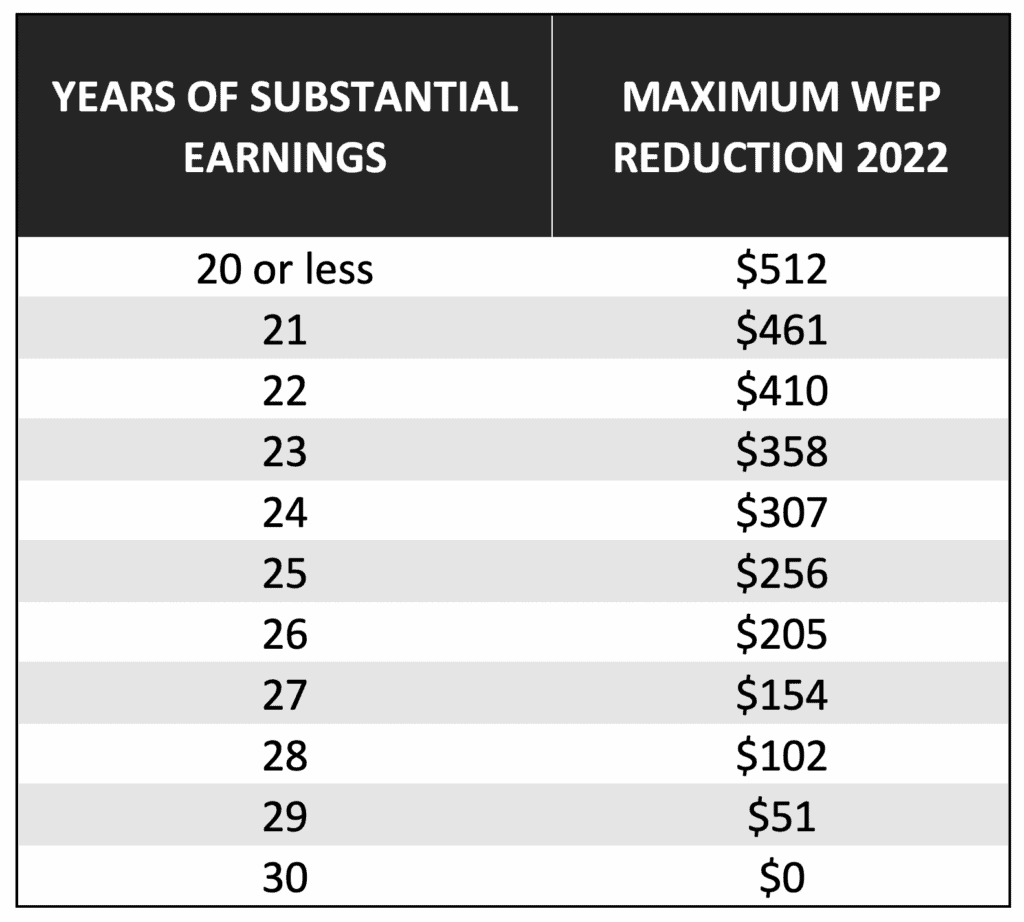

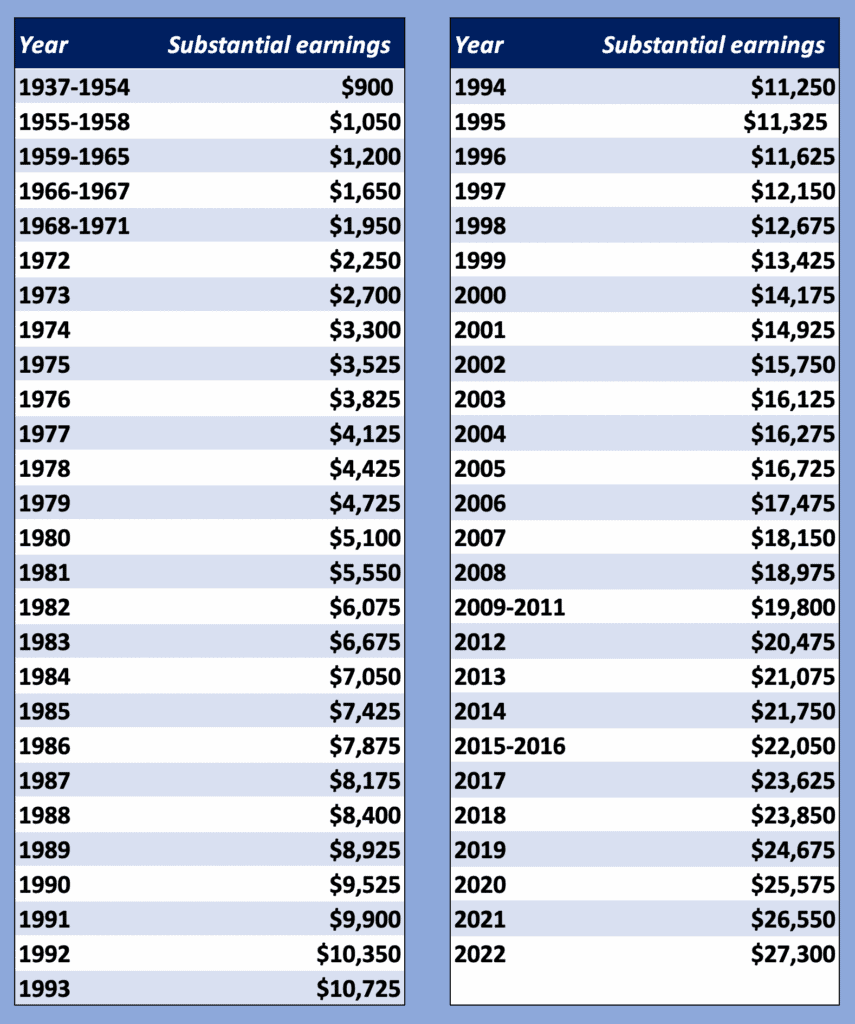

- The maximum Social Security reduction will never exist greater than ane half of your pension amount. This is capped at a monthly reduction of $512 maximum WEP reduction (for 2022).

- If you have more than than 20 years of substantial covered earnings (where you lot paid Social Security tax), the impact of the WEP begins to diminish. At 30 years of substantial covered earnings, the WEP does not employ.

Image Source: Devin Carroll, Data: Social Security Administration

This phase-out of the WEP reduction offers a great planning opportunity if you lot have worked at a task where y'all paid Social Security tax. For case, if yous worked every bit an engineer for 20 years earlier you began instruction, y'all may be able to do enough part fourth dimension work between now and when y'all retire to completely eliminate the monthly WEP reduction.

Would it be worth it? If you consider how much more in benefits you could receive over your retirement lifetime, it could be worth $100,000 in extra income over a xx-year retirement.

Obviously, non everyone has the option of accumulating enough years to wipe out the big monthly WEP reduction. But for those who practise, or tin get shut, it's worth taking a closer expect.

Calculating How the WEP Will Touch on Y'all

I know this is a lot to follow, so if yous desire to take a shortcut in figuring out how the touch of the WEP, y'all may desire to utilize my free calculator.

This calculator volition tell you:

- The amount of monthly Social Security do good you lot tin can expectafter the WEP reduction (for comparing we also illustrate your benefitwithout considering the WEP).

- The number of "substantial earnings" years you already have

- How boosted years of substantial earnings volition affect the WEP penalty

To use this calculator y'all'll need to get a copy of your earnings history from the SSA. You lot should but put in your years of earnings that were covered past Social Security.

Access this calculator HERE

For more than information on the Windfall Elimination Provision, come across these helpful resources:

- The Social Security Administration's WEP Benefit Calculator.

- My article on The Best Explanation of the Windfall Emptying Provision

- My article on the potential repeal of the WEP

What About the Government Alimony Offset?

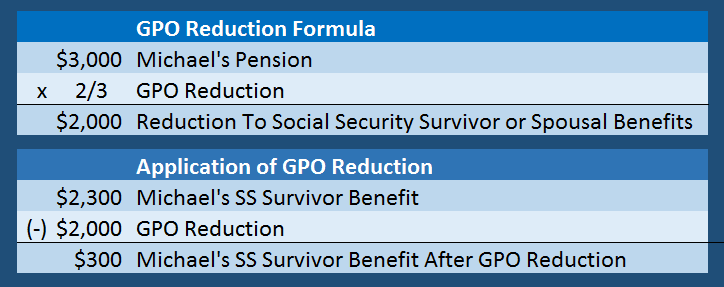

The nitty-gritty of the Government Pension Get-go (GPO) is elementary. If you run across both of requirements for the GPO – you lot are entitled to a Social Security benefitevery bit a survivor or spouse andhave a pension from a authorities job where you did not pay Social Security revenue enhancement – your Social Security survivor or spousal benefit will be reduced by an amount equal to ii-thirds (2/3) of your pension.

As an example, let's say Michael worked for xxx years as a teacher in California (one of the fifteen states where schoolteachers are not covered past Social Security) and his wife was an accountant.

Upon retirement, he began receiving his California teacher'southward retirement pension of $3,000 per month. His wife retired at the same time and filed for her Social Security benefits of $2,300 per month. Sadly, she passed abroad a short 3 years afterwards.

Upon her expiry, Michael learned that considering of his CalSTRS pension he would not exist eligible to receive a normal Social Security survivor's benefit. Cheers to the GPO his survivor's do good was reduced to a measly $300 per month. Here'due south the math:

Source: Devin Carroll

Some would say that'southward not fair and I call back they have a compelling point. Why? In a case like this the GPO simply applies because of Michael'south chosen profession. This is effectively a penalty for teaching (what some telephone call the hero's penalisation).

If he had been a chemist instead of working in education, he would have been eligible to receive the full $2,200 per calendar month.

If you'd similar to dig into the Government Pension Offset a petty deeper, see my article on What You Should Know Well-nigh the Government Pension Offset.

If You Only Authorize for a Instructor's Retirement Organization Pension

If you have never paid Social Security revenue enhancement and just qualify for your teacher's retirement, it's likely you'll never receive a Social Security benefit.

Although this makes perfect sense to some, others think it's still pretty unfair that this isn't true for everyone. For case, if you lot had called to stay at home every bit the household manager, you would not have paid into the Social Security system. Nonetheless, you would be eligible for spousal and survivor benefits.

These intricate Social Security regulations and how differently they may affect a worker'due south retirement income make information technology critical that y'all plan ahead and gear up. Before yous brand your elections on your teacher'due south pension, you must consider how your monthly cash flow would alter with a spouse'southward death.

As a teacher, yous have plenty to proceed upwardly with and these circuitous rules on Social Security don't make it any easier. That's why it's of import to have a quick and piece of cake source of data at your disposal so tin make the best decisions for you lot and your family.

What to Do If You Notwithstanding Have Questions

Don't leave without getting your FREE re-create of my latest guide: Peak 10 Questions and Answers on the Windfall Elimination Provision. Yous Can simplify these rules and go every dime in benefits y'all deserve! Simply click here http://www.devincarroll.me/top10WEPSSI.

If y'all have questions, you lot could exit a comment below, but what may be an even greater assistance is to bring together my FREE Facebook members group. It'due south very active and has some really smart people who beloved to answer any questions yous may have well-nigh Social Security. From time to fourth dimension I'll even drop in to add my thoughts, as well.

You should too consider joining the 365,000+ subscribers on my YouTube channel! For visual learners (every bit most of united states are), this is where I break down the complex rules and help you figure out how to use them to your reward.

And don't leave without getting your FREE copy of my Social Security Cheat Sheet. This is where I took the most important stuff from the 100,000 page website and condensed it down to only I PAGE! Go your Costless re-create here.

Can A Widow Thats 54 Draw From Her Husband Retirement Of A Public School,

Source: https://www.socialsecurityintelligence.com/teachers-retirement-and-social-security/

Posted by: jacobsfooster.blogspot.com

0 Response to "Can A Widow Thats 54 Draw From Her Husband Retirement Of A Public School"

Post a Comment